The Collector Car Market’s Slide Has Paused, for Now

The Hagerty Market Rating measures the current status of the collector car market in terms of activity or “heat,” directional momentum, and the underlying strength of the market. It is expressed as a closed 0-100 number with a corresponding open-ended index (like the DJIA or NASDAQ Composite). To learn more about how we calculate the Hagerty Market Rating, read here.

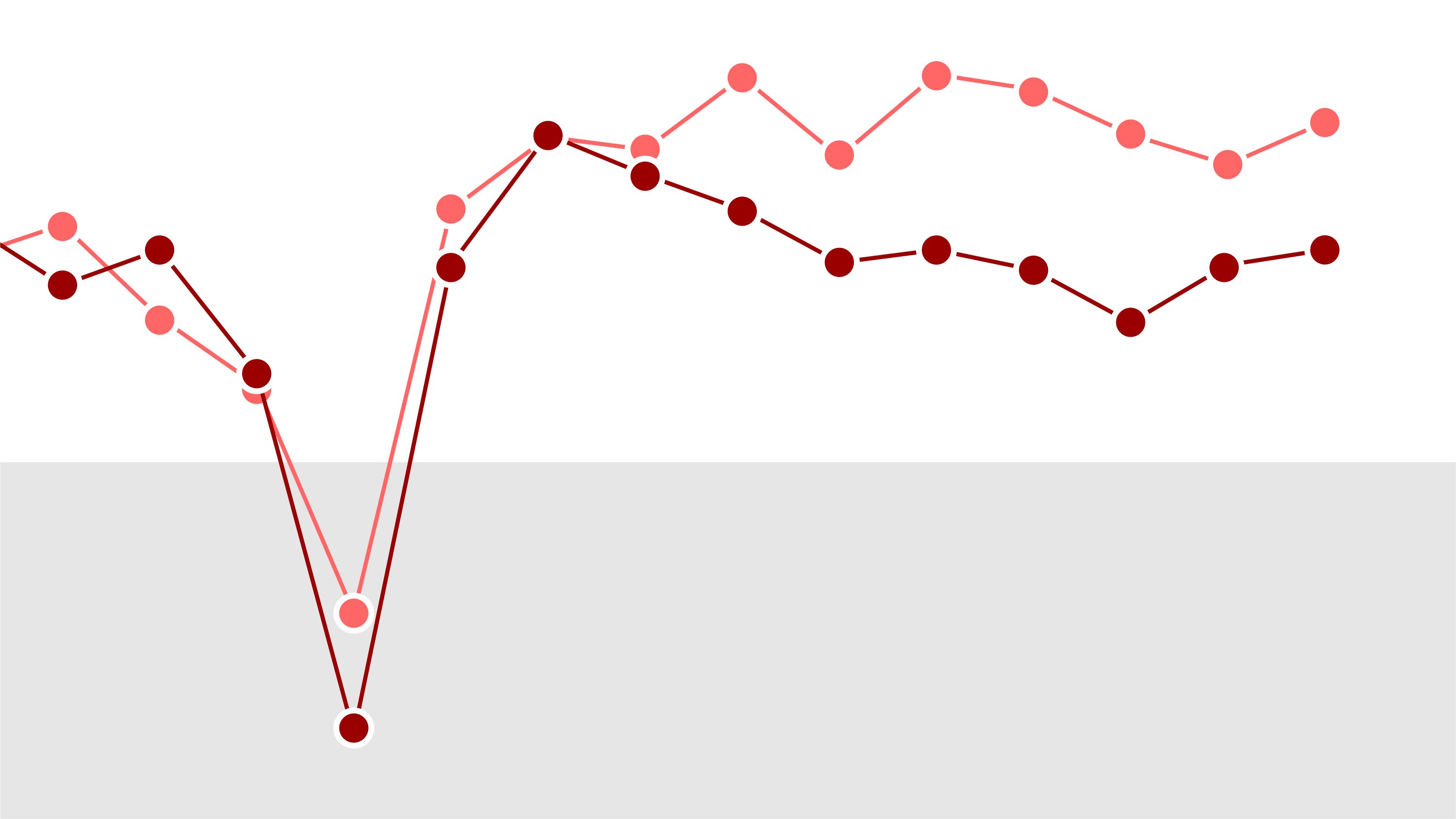

Last month, we declared the collector car market officially flat, as the Hagerty Market Rating dipped into the 50s for the first time since 2020. After a 0.42-point increase this month, though, the Market Rating has quickly moved out of “flat market” territory and returned to “expanding market” status with a current score of 60.26. This is the first increase the Market Rating has seen in 4 months and only the second increase in the past year. Since 2012, the Market Rating has only been below 60 for two months, quickly rebounding both times.

The Hagerty Market Index, an open-ended stock-market-style version of the Market Rating, decreased by another 0.61 points this month. In the two-and-a-half years following the Hagerty Market Index’s high point in late 2022, the Index has only increased twice. While currently at its lowest value in over three years, it is still relatively high in the context of the Index’s 18-year-long history, as visible in the chart below.

Only three of the Market Rating’s 14 individual metrics increased this month, with the most substantial occurring on the private side of the market. Private Sales Activity saw a 3.3-point bump, its largest single-month increase in three-and-a-half years. While one half of this Private Sales combined metric—the Percentage of Cars Selling Above Insured Value—actually dropped below 38% for the first time since early 2022, the other half saw a significant increase to pull the combined metric up. Average Private Sale Price jumped 5.2%, the second largest single-month increase ever, thanks primarily to a recent $3.9M sale and two other seven-figure sales last month. Sales of this caliber are relatively uncommon in our private sales data and three so close together had a notable affect on the Average Private Sale Price. Aside from these three, we have seen only six other sales over $1M in our private market data in the past 18 months.

On the public-facing side of the market, our combined Auction Activity metric was relatively flat. The Count of Cars Sold increased slightly but was offset by a drop of equal magnitude for Median Price, which continues to set a new record low.

Lower auction prices are the main factor contributing to our industry experts’ outlook on the classic car market. While optimism within this group increased slightly this month, moving up into the 50s for the first time since January, they are still cautious. The experts have noticed many repeat sales changing hands at a loss and fewer records being set compared to recent years. It appears that many buyers and sellers are holding back. Our Macro Economic indicator dropped to its lowest value since December 2020, as people outside the classic car market also retreat. Auction analyst and industry expert Rick Carey has a theory: “There almost seems to be a suspension of interest, perhaps while political/social/financial/economic issues settle out and there is some lessening of the fog of uncertainty obscuring the future.”

We will need to wait and see how the greater economy continues to effect the classic car market. While the Market Rating’s most recent dip into the 50s was short-lived, expect to see more scores in the 50s by year’s end.

link